Streamlined finance operations deliver massive value for organizations. They pay vendors and partners on time, handle payments from customers, keep track of assets and liabilities and prepare reports for auditors, investors, and regulators. They also help allocate organizational resources equitably to spur product growth, acquire new customers, and invest in new markets.

But in many organizations finance operations are manual. Accountants and Financial Planning and Analysis (FP&A) professionals still rely on flat files such as Excel and CSV to import and export data from one system to another. While this manual process is infinitely flexible, it consumes a lot of time and is error prone. If processes are manual, the problem is exacerbated during quarter-end close when the finance team need to close books quickly and report key KPIs to company leadership and investors.

The SnapLogic team spoke with a number of finance professionals who have automated key processes. Automating finance processes helps them get more real-time data, reduces a lot of manual work, allowing them to focus on more strategic activities such as budget allocation and growth planning.

If you haven’t yet automated your finance operations, here are 5 impactful ways to kickstart that process.

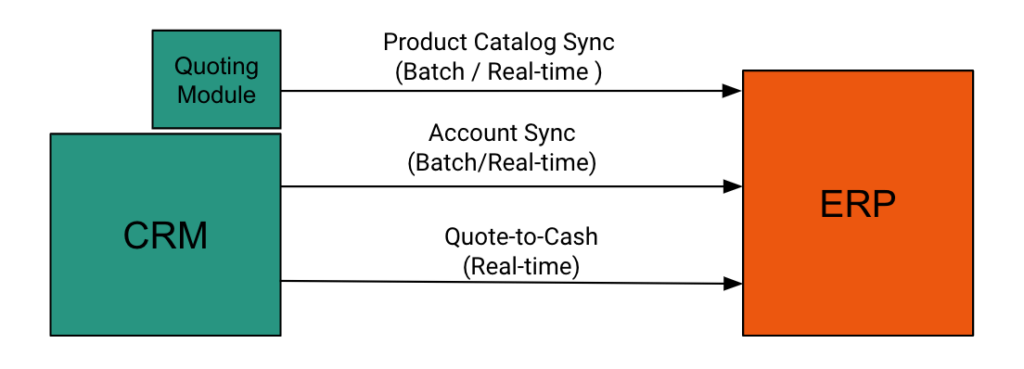

1. Quote-to-cash automation

One of the most impactful steps to FinOps automation is quote-to-cash automation, also known as accounts receivable (AR) automation, because it is a faster path to revenue. Quote-to-cash automation involves applications for customer relationship management (CRM) and enterprise resource planning (ERP):

- CRM tools: Salesforce, MS Dynamics 365 Sales, Hubspot, etc.

- ERP tools: NetSuite, SAP ECC, SAP S/4HANA, Microsoft Dynamics 365 Finance, Workday Finance, etc.

As soon as a sales rep marks an opportunity “Closed-won” it can create a sales order in the ERP system. If a customer requires a “Purchase Order” for invoice payments, when it is generated the sales order is converted to an invoice and sent out to a customer for a payment.

Quote-to-cash automation also has other positive side effects. Because it can bring in revenue to the company faster, sales representatives also end up getting their commission sooner, leading to a happier sales team. Additionally, the accounting team no longer has to chase after the sales team for customer payments, saving them valuable time.

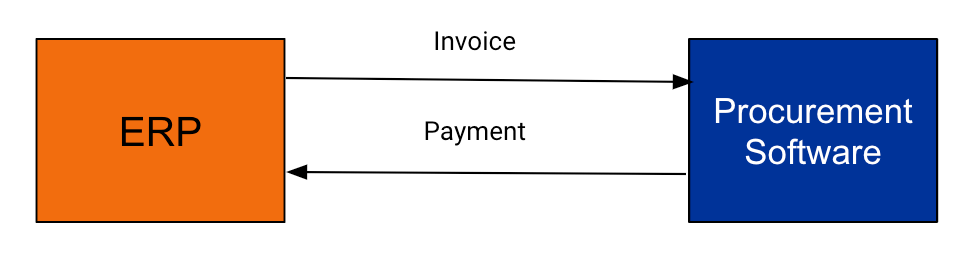

2. Procure-to-pay

Procure-to-pay automation between the ERP system and a procurement platform (e.g., SAP Ariba, Coupa, etc.) streamlines procurement of goods and services from trading partners and vendors. Large organizations tend to purchase these procurement platforms. Hence when small organizations are doing business with larger organizations, purchase orders from customers are made available in those systems. After that, invoices and payment for the invoices are all sent and received via these platforms.

Procure-to-pay automation helps the finance team support the organization in acquiring services and helps meet customer requirements to get revenue on time. In the absence of a procurement platform, smaller organizations rely on homegrown procurement systems that can involve online forms, email based approvals and invoices, followed by payments, all of which can greatly benefit from automation.

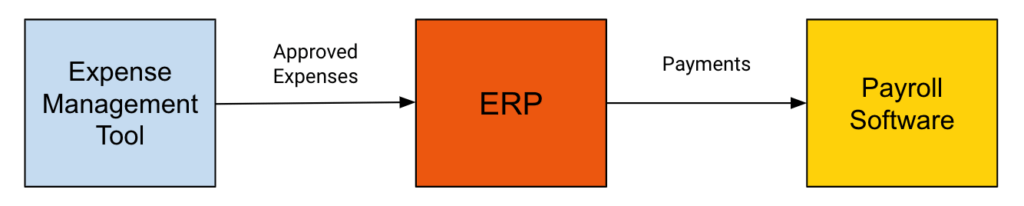

3. Employee expense management

Another key process that the finance team handles is the payment of employee expenses. Employee expenses recorded through Expensify/ SAP concur, etc. can be numerous depending on the size of the organization, so managing their flow, handling approvals, and paying the employees without any manual intervention is crucial for the sanity of your accounting team. Automation of these expense management processes helps get them in the approval process quickly, leading to faster reimbursement to the employees.

4. Month-end/quarter-end close

Month-end close and quarter-end close are critical finance processes that leverage existing integrations between your ERP, CRM, and AR systems, along with other software or flat files that track sales commissions, deferred revenue etc.

With these processes, there is a need for real-time integrations, so that the finance team can close the books in a minimum number of days, and make the final revenue, expenses, cash flow numbers available for financial reporting and analysis as soon as possible. Month-end and quarter-end processes are especially complicated when your organization is globally distributed and when you have to recognize revenues, liabilities, and commissions in foreign currencies.

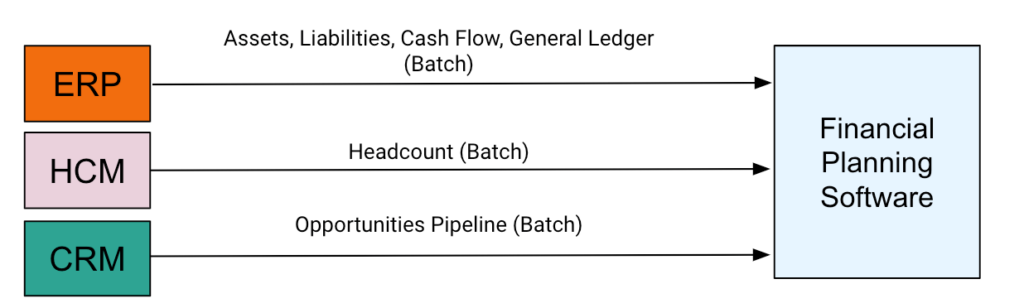

5. Financial planning and analysis (FP&A)

FP&A processes need data not just from ERP applications but also from CRM (for opportunities), Human Resource Management (HRM) system (for headcount) to predict and plan for future revenue growth, opportunities pipeline, and headcount growth.

While finance teams don’t need real-time data for accurate forecasting, FP&A teams do benefit greatly from faster month-end/quarter-end close activities that can help provide accurate data faster for company leadership, the board of directors, and investors.

This is the second post in a multi-part series about automating financial operations. In the first blog, we identified The Top 3 Challenges of ERP Integration. Up next, we’ll give tips on how to automate financial operations for quarter-end close and beyond.