Case Study

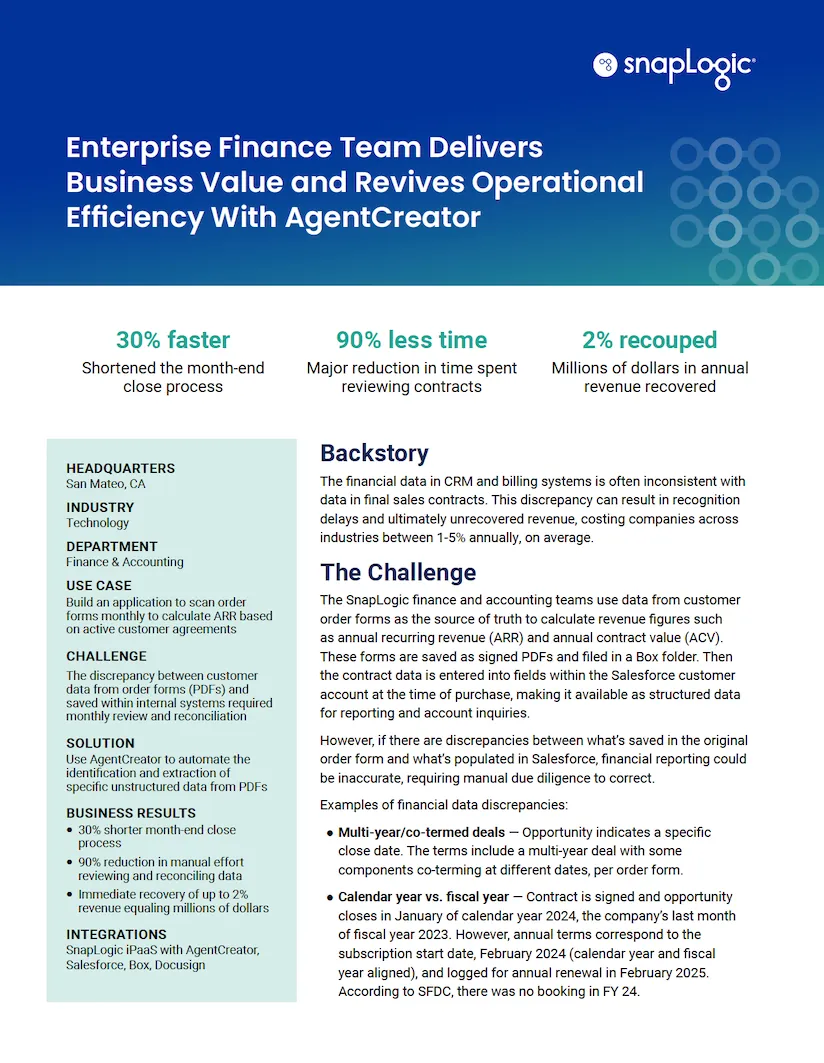

Enterprise Finance Team Delivers Business Value and Revives Operational Efficiency With AgentCreator

The financial data in CRM and billing systems is often inconsistent with data in final sales contracts. This discrepancy can result in recognition delays and ultimately, unrecovered revenue.

SnapLogic’s finance and accounting teams use data from customer order forms as the source of truth to calculate revenue figures such as annual recurring revenue (ARR) and annual contract value (ACV). However, if there are discrepancies between what’s saved in the original order form PDF and what’s populated in Salesforce, financial reporting could be inaccurate, requiring manual due diligence to correct.

After working with a customer to automate a similar process with AgentCreator, SnapLogic embarked on a journey to empower the finance and accounting teams with an application of their own.

Hear how SnapLogic’s own Senior Finance Manager, Nicole Houts and the rest of the finance team, built this game-changing GenAI automation

Note: The GenAI App Builder functionality is now a part of AgentCreator

By automating the data reconciliation process and ensuring numbers are the same across the board, the finance department gained immediate benefits, including:

- 30% faster month-end close process

- 90% less time manually reviewing contracts

- 2% revenue (millions of dollars) recouped

Get the case study to learn how to use SnapLogic AgentCreator to optimize finance processes.